Corporate Governance

Basic Stance

To achieve success in global competition and realize sustainable growth, we believe it is important to build corporate governance system that support this. To that end, we have built a structure which utilizes to the maximum the worldwide resources we possess and have worked to incorporate a wide range of opinions to strengthen our management foundation and technology base, establishing a governance structure capable of ensuring that we attain global-level earnings power. We have established the Corporate Governance Guidelines* and outlined the corporate governance structures that we have developed and reinforced to date, in advance of other companies.

Hybrid Governance Structures

We have enhanced the independence of the Board of Directors and strengthened its supervisory function by having outside directors make up the majority of the board, while ensuring an auditing function by the Audit & Supervisory Board, which is independent of the Board of Directors. We have also established a Nomination Committee and a Compensation Committee, both of which are chaired by outside directors, and in which outside directors make up the majority of each. Furthermore, we have also introduced a Corporate Officer system, and through the appropriate delegation of authority, we are working to establish a strong execution system with quick decision-making and agile business execution. In this way, we have established an effective, hybrid type of governance system that utilizes the advantages of the Audit & Supervisory Board system and also incorporates elements of the Company with Three Committees.

Characteristics of Our Corporate Governance

| A Board of Directors that is Independent and Diverse

|

Strengthening the Functions of the Executive Side

|

Advanced Initiatives Taken Ahead of Other Companies |

|---|---|---|

|

|

|

Introduced for the purpose of better ensuring continuous improvements to corporate value, and definitive sharing of profits with stakeholders (effective as of July 1, 2021; revised on April 30, 2024 for CEO and for inside directors and corporate officers). We have set goals to, after these Guidelines are revised or within five years of inauguration, retain TEL shares equivalent to the values described below.

CEO 6 × fixed basic compensation (annual amount), Inside Directors, Corporate Officers 3 × fixed basic compensation (annual amount), Outside Directors, Executive Officers 1 × fixed basic compensation (annual amount)

Effective as of July 1, 2021. Demands the return of performance-linked compensation if major corrections of financial figures are deemed necessary due to intentional misconduct of Executive Directors and Corporate Officers. The compensation that will be subject to return will be the excess portion of performance-linked compensation received during the fiscal year in which the misconduct was discovered, as well as such compensation received during the preceding three fiscal years.

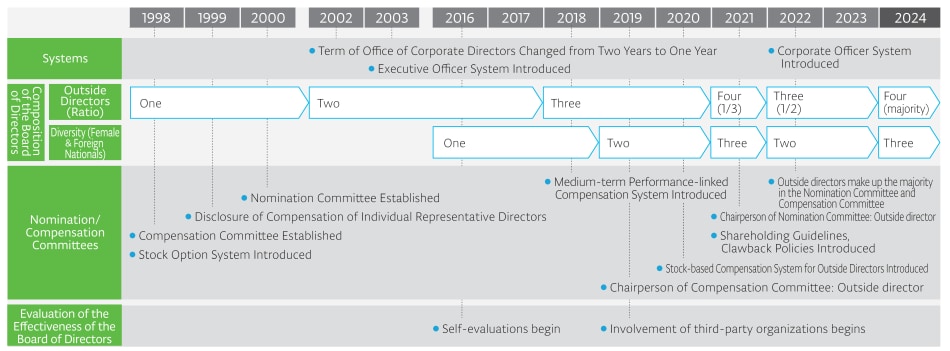

Changes in Corporate Governance (Since CY1998)

Purpose of Committees on the Executive Side

| Committee Name | Meeting Frequency | Purpose |

|---|---|---|

| Business Ethics Committee | Twice annually | Verifies the status of practice in accordance with the Code of Ethics; proposes and supports training and educational programs relating to business ethics; confirms compliance promotion activities |

| Sustainability Committee | Twice annually | Considers and formulates sustainability-related policies; sets and manages sustainability goals; implements company-wide projects (the environment, human rights, RBA, etc.) |

| Risk Management Committee | Twice annually | Performs and shares information on company-wide risk management; establishes systems and mechanisms to investigate and counter risk scenarios for individual risk items in collaboration with risk owners |

| Information Security Committee | Twice annually | Spreads awareness of information security strategies and policies; shares the current status of information security plans, etc. |

| Export Trade Control Committee | Annually | Promotes export compliance activities |

Main Topics for the Board of Directors and Off-site Meetings

| CEO |

|

|---|---|

|

Medium- to Long-term Growth Strategies

|

|

| Sustainability |

|

|

Risk/Compliance

|

|

|

Corporate

Governance

|

|

CSS (Corporate Senior Staff)

For the purpose of fostering common understanding of management strategies throughout the Group and promoting strategy execution efficiently and forcefully by managing the progress on management plans and reviewing additional measures from a global, cross-organizational perspective and a medium- to long-term management perspective, without being encumbered by short-term perspectives of each area of responsibility, we have established Corporate Senior Staff (CSS), consisting of our executive officers and senior management of overseas subsidiaries. CSS members meet four times a year.

Meeting held in Taiwan in March 2024

Corporate Officer System

As a leading company in the semiconductor production equipment industry, we introduced our unique Corporate Officer system in June 2022 to further strengthen governance and implement quick decision-making and agile business execution. Corporate officers are the highest-level officers on the executive side within the Group and are responsible for the management of the entire Group, taking the same perspective as the CEO. In addition, corporate officers attend Board of Directors meetings, where they give briefings on business execution. This is beneficial for the Board of Directors to properly supervise the executive side and for discussions at Board of Directors meetings to be put to use appropriately and speedily in business execution, and also contributes to the promotion of proactive management.

We have also established the Corporate Officers Meeting as the highest decision-making body on the executive side. Sessions of the Corporate Officers Meeting are held once a month as a basic principle, with inside directors and inside Audit & Supervisory Board members (who are not corporate officers) taking part in addition to the corporate officers. The meetings contribute to the realization of agile business execution by quickly deliberating and making decisions on key items on the executive side, including those items for which authority has been delegated from the Board of Directors to the executive side.

Furthermore, effective July 2024, we have renamed the position of division general managers (the head of each divisional organization) and established the position of division officer. Division officers are responsible for the global operations of their respective divisions and are in charge of developing and executing effective strategies and promoting “offense×offense governance,” including risk management.

| Highest position on the executive side within the Group | Has responsibility for execution of the entire company’s management, taking the same perspective as the CEO |

|---|---|

| Members of the Corporate Officers Meeting | Realizes agile business execution by quickly deliberating and making decisions on key items on the executive side |

| Attendance at Board of Directors meetings (without voting rights) | Utilizes discussions at Board of Directors meetings appropriately and speedily for business execution |

Corporate Officer’s Message

Corporate Officer

Executive Vice President

- Effect of Introducing the Corporate Officer System

- Challenges for the Future

The Corporate Officer system has become an established structure that has gained in significance within the Company. Each corporate officer is now even more aware of their role of taking the same perspective as the CEO, and as such they are engaging actively from a broader perspective at meetings of the Board of Directors. The Corporate Officers Meeting, which functions as the highest decision-making body on the executive side, also conducts timely and lively discussions on various topics, including matters for which authority has been delegated by the Board of Directors. I feel that this body has evolved over the two years since the system was introduced. Items discussed at the Corporate Officers Meeting are also shared with the Board of Directors, which plays a role in the supervision of the Board’s business execution as well.

We recognize that there is an urgent need to recruit and develop successors for each corporate officer position to ensure we can strongly promote important matters aimed at medium- to long-term growth strategy and corporate value enhancement. Our corporate officers are all spending time discussing this subject and they are making steady progress in developing succession plans. In this way, corporate officers who share the same perspective as the CEO will be able to focus on higher-level management issues.

Establishment of the Director Compensation System

Basic Policy on Director Compensation

Our Group emphasizes the following points in its basic policies on compensation for corporate directors and Audit & Supervisory Board members.

|

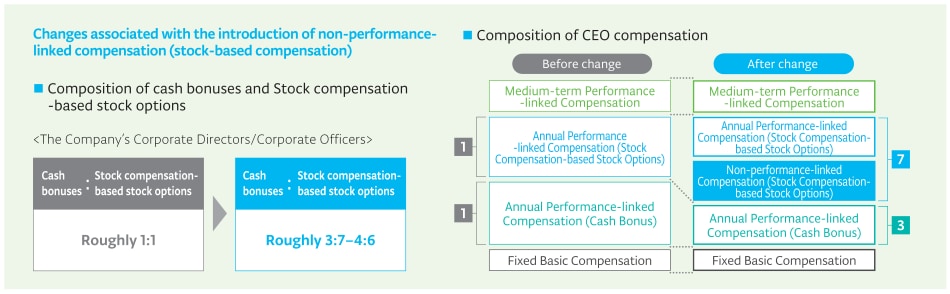

Compensation Structure

Regarding compensation for inside directors, in fiscal year 2024, the ratio of stock-based compensation in annual performance-linked compensation was increased, with a portion of it being made non-performance-linked compensation (stock-based compensation). As a result, compensation for inside directors consists of fixed basic compensation, annual performance-linked compensation, medium-term performance-linked compensation and non-performance-linked compensation (stock-based compensation).

The following table sets out an overview of our policies and decision-making methods for each type of compensation.

| Type of Compensation | Recipient | Overview of Compensation | |||

|---|---|---|---|---|---|

| Inside Directors | Outside Directors |

Audit &

Supervisory

Board

Members

|

|||

| Fixed Basic Compensation | ○ | ○ | ○ |

|

|

| Annual Performance-linked Compensation | Cash Bonuses | ○ | ー | ー |

|

| Stock Compensation-based Stock Options | ○ | ー | ー | ||

| Medium-term Performance-linked Compensation | Performance Share (Stock-based Compensation) | ○ | ー | ー |

|

Non-performance-linked Compensation |

Stock

Compensationbased

Stock

Options

|

○ | ー | ー |

|

| Restricted Stock Units (Stock-based Compensation) | ー | ○ | ー |

|

|

Evaluating the Effectiveness of the Board of Directors

Overview of Evaluations of Effectiveness

To further enhance our governance and the effectiveness of the Board of Directors, we have conducted annual evaluations of the effectiveness of the Board since fiscal 2016 and have disclosed summaries of the results.

Evaluation of the Effectiveness of the Board of Directors for Fiscal Year 2024

-

Scope of Evaluation

- Board of Directors overall (including details of the activities of the Nomination Committee and Compensation Committee)

-

Process

- In light of the results of analysis by external experts based on questionnaires and individual interviews, we conducted a self-evaluation following extensive discussion at meetings of the Board of Directors and at meetings for the exchange of opinions by outside directors and outside Audit & Supervisory Board members.

-

Evaluation Items

- The main evaluation items for evaluating effectiveness are as follows.

|

|

State of response to issues in the previous fiscal year’s effectiveness evaluation

| Issues | State of responses |

|---|---|

| Aiming to become the top company globally in the medium- to long- term we will continue to work on each of the following matters to further strengthen the supervisory function of the Board of Directors and the management and execution functions of the executive side and will further enhance its effectiveness by regularly reviewing its progress. |

|

| The Company will systematically set agendas in line with medium- to long-term strategies and issues for growth, and will enhance discussions from a long-term perspective. |

|

| The Company will enhance the effectiveness of the Corporate Officers Meeting, the highest decision-making body on the executive side. |

|

| The company will conduct an analysis of the decision making of the Board of Directors, clarify the points of deliberation, and enhance opportunities for sharing information with outside directors and outside Audit & Supervisory Board members on occasions other than board meetings and off-site meetings. |

|

Overview of Fiscal year 2024 Evaluation Results

The Company’s Board of Directors believes that the Board of Directors is very effectively ensuring that the key roles and obligations of the Board of Directors are being fulfilled, and that the Board, including the Nomination Committee and the Compensation Committee are functioning effectively. The results of analysis and evaluation by external experts also confirmed that our Board of Directors operates effectively and engages in free and open-minded discussion, and that there has been a positive trend toward improvement with regard to issues raised in the previous fiscal year. In addition, it was pointed out that the Company has entered a stage where discussions at the Board of Directors should focus on the overarching perspective of being a "leading global company," and that as a prerequisite to that, the role expected of the Board of Directors is being looked into.

Based on the results of the external experts' analysis and evaluation, discussion at the Board of Directors will continue on the functions and roles that it should play in light of the Company's desired vision for sustainable growth, and the necessity to further strengthen its management and execution functions has been recognized.

Future Initiatives

In light of the results of this evaluation, the Company will engage in the initiatives below, and carry out periodic progress reviews to further increase efficacy in those areas.

Role and function of the Board of Directors

|

Messages from Newly Appointed Outside Directors and Outside Audit & Supervisory Board Members

It is an honor to join the Board of Directors of Tokyo Electron, a leader in the semiconductor production equipment industry. Tokyo Electron’s Vision and TEL Values resonate very much with me and are principles and values that I can be proud of. I am fully committed to supporting the management team’s growth strategy, technological innovation and value creation efforts. I will also endeavor to be constructive and proactive in my supervisory and advisory role as a director.

Global enterprises are facing unprecedented geopolitical risk, information security, industrial competition, activism and social responsibility challenges.

I have been involved in international finance for nearly 40 years, and as part of that experience, I have reflected on the macroeconomy, security, monetary and fiscal policy, and the political situation between the United States and Japan. I will fulfill my responsibilities as a director in good faith for the development of the Company and to meet the expectations of employees and all stakeholders.

Newly appointed Outside Director

Tokyo Electron embraces an important mission of driving technological innovation in semiconductors and supporting the sustainable development of society. I respect its corporate culture of effecting change by viewing it as an opportunity—a culture that has supported Tokyo Electron’s innovation—and as a member of the Board of Directors, I will actively support taking on new challenges and sound risks.

In an environment of increasing uncertainty, I recognize that management requires increasingly diverse perspectives. In the past, I was in charge of brand business and DE&I in a completely different industry. Drawing on the different nature of my career , I hope to help reduce any blind spots in Tokyo Electron’s vision and to contribute to the development of organizational capacity that supports innovation, that is, a corporate culture that leverages diversity.

To meet stakeholder expectations, I will strive to improve Tokyo Electron’s management foundation and corporate value with a steady eye to the future through constructive discussions with fellow directors and the executive leadership team.

Newly appointed Outside Director

I am honored to be appointed as an outside Audit & Supervisory Board member at Tokyo Electron, a company that continues to pioneer the frontier of the semiconductor industry. Since its founding as a trading company specializing in technology , Tokyo Electron has consistently worked with its customers to remain at the forefront of innovation, transforming and developing its business model while steering its way through many adversities to reach the position it holds today. I believe that Tokyo Electron’s voracious frontier spirit and flexibility in thought—even after more than 60 years in business —is a distinctive quality of the Company and is the source of its competitiveness.

Having lived through a period of upheaval and change in the financial world—from rapid economic growth, to collapse of the bubble economy and financial difficulty, to reform of financial and capital markets, and responses to innovation in financial technology—I have keenly felt the importance and difficulty of maintaining a balance between the maintenance and improvement of entrepreneurial spirit and the establishment of effective governance.

Leveraging that experience, the lessons learned and my knowledge as a financial expert, I will do all I can to contribute to the realization of dynamic and effective corporate governance from a position of integrity and fairness, which in turn will contribute to sustainable growth and the enhancement of corporate value over the medium- to long- term.

Newly appointed Outside Audit & Supervisory Board Member

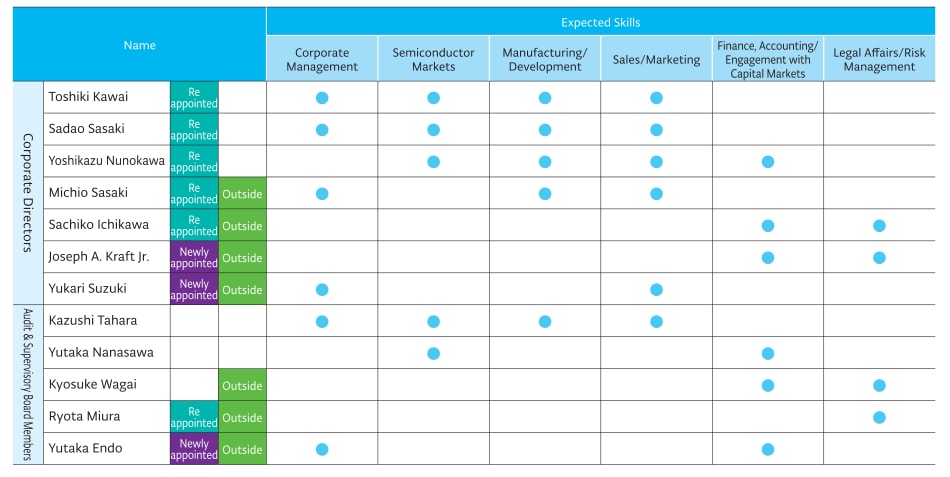

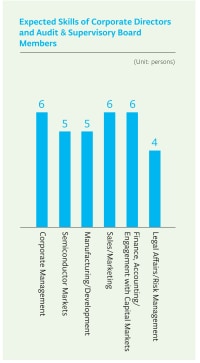

Skills Matrix

We will achieve the medium-term goals in each material issue and realize medium- to long-term profit expansion and continuous corporate value enhancement through each corporate director and Audit & Supervisory Board Member, who have demonstrated their skills in Global Business, Governance, Sustainability, and others listed below as determined by the Nomination Committee and the Board of Directors.

Definition of Expected Skills and Reasons for Nomination

| Corporate Management | Experience of corporate management (experience serving as a representative director or chairman/president) is necessary to fulfill the supervisory function of the Board of Directors and achieve "offense×offence governance. |  |

|---|---|---|

| Semiconductor Markets | Knowledge of the semiconductor markets is necessary to further promote aggressive management in the semiconductor production equipment industry which is characterized by rapid technological innovation and dynamically changing market. | |

|

Manufacturing/ |

Knowledge/experience in manufacturing and development at TEL and other manufacturers are necessary to strengthen research and development capabilities based on technological trends and customer needs, and to establish environmentally considerate and efficient manufacturing operations. | |

| Sales/Marketing | Knowledge/experience in sales and marketing at TEL and other manufacturers are necessary to be the sole strategic partner for our customers and contribute to further value creation through proposing optimal solutions. | |

| Finance, Accounting/Engagement with Capital Markets | Knowledge in financial accounting and M&A, or knowledge/experience in engagement with capital markets are necessary to formulate and execute growth and financial strategies, improve capital efficiency, and further enhance shareholder value through shareholder returns. | |

| Legal Affairs/ Risk Management |

Knowledge of legal affairs, compliance, and risk management is necessary to appropriately respond to increasingly complex and diverse risks throughout the Group as opportunities for business growth. |

Engagement with Capital Markets

Our management actively engages in IR (Investor Relations) and SR (Shareholder Relations) activities to contribute to our sustainable growth and increase corporate value over the medium- to long- term.

In terms of IR activities, the CEO and each company’s executive appear at quarterly financial announcement and Medium-term Management Plan briefings to share our business strategies and growth story with stakeholders and institutional investors. We have also established the IR Department, within the Corporate Strategy Division, to enable deeper discussions with our investors.

In fiscal year 2024, we established an IR brunch in New York, which increased opportunities for face-to-face dialogue with investors in North America and increased awareness of us and Japan’s semiconductor production equipment industry.

As a part of our SR activities, company executives play a central role in constructive dialogue with our major investors and proxy advisory firms. In addition to explaining the Shareholders’ Meeting agenda in advance, we engage in repeated dialogue throughout the year on a wide range of topics, including policies on corporate governance and sustainability, and initiatives for the environment, human rights and DE&I, and we work to deepen mutual understanding. Opinions gathered from dialogues with investors are regularly reported to management and the Board of Directors.

Main Activities

| Engagement with Capital Markets*¹ |

IR Activities |

|

|---|---|---|

| SR Activities |

|

|

| Provision of Information | Financial announcement Medium-term Management Plan announcements |

|

| Shareholder’s meeting |

|

|

|

Disclosure of Materials

|

IR-related |

|

Fiscal year 2024

Including tours of plants and overseas IR road shows

Overseas IR road shows: IR activities presented directly to shareholders and investors