Corporate Governance

Basic Stance

To achieve success in global competition and realize sustainable growth, we believe it is important to build corporate governance system that support this. To that end, we have built a structure which utilizes to the maximum the worldwide resources we possess and have worked to incorporate a wide range of opinions to strengthen our management foundation and technology base, establishing a governance structure capable of ensuring that we attain global-level earnings power. We have established the Corporate Governance Guidelines* and outlined the corporate governance structures that we have developed and reinforced to date, in advance of other companies.

Hybrid Governance Structures

We have enhanced the independence of the Board of Directors and strengthened its supervisory function by having outside directors make up the majority of the board, while ensuring an auditing function by the Audit & Supervisory Board, which is independent of the Board of Directors. We have also established a Nomination Committee and a Compensation Committee, both of which are chaired by outside directors, and in which outside directors make up the majority of each. Furthermore, we have also introduced a Corporate Officer system, and through the appropriate delegation of authority, we are working to establish a strong execution system with quick decision-making and agile business execution. In this way, we have established an effective, hybrid type of governance system that utilizes the advantages of the Audit & Supervisory Board system and also incorporates elements of the Company with Three Committees.

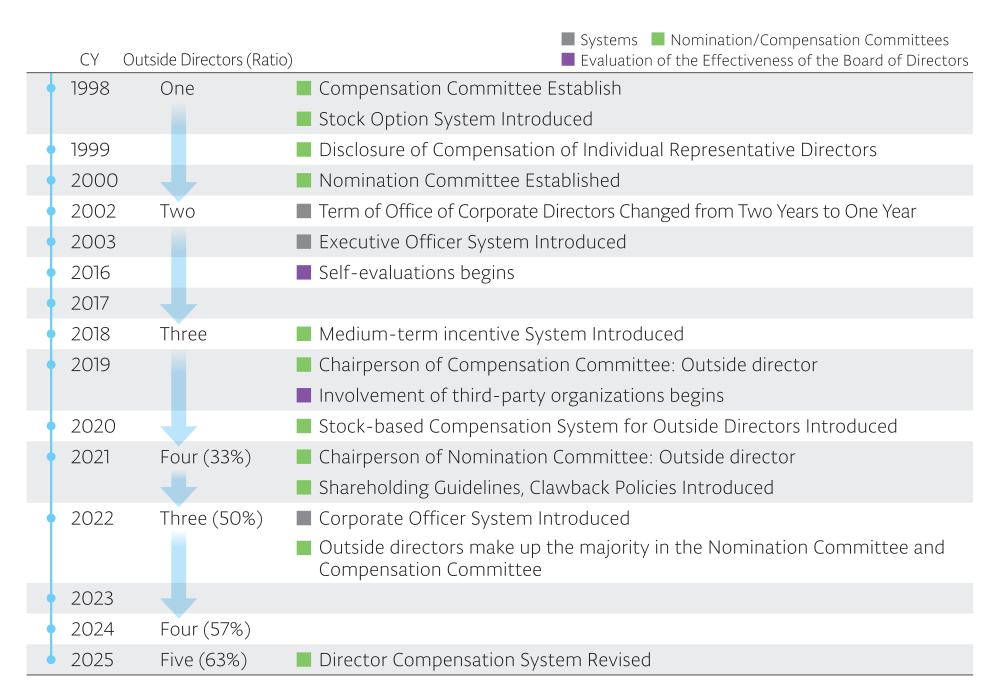

Changes in Corporate Governance (Since CY1998)

Committees on the Executive Side

| Business Ethics Committee | Promote and oversee corporate ethics and compliance to ensure compliance with the Code of Ethics (review of systems, promotion of education and awareness-raising activities and confirmation of the use of the internal reporting system) | Twice annually |

| Sustainability Committee | Considers and formulates sustainability-related policies; sets and manages sustainability goals; implements company-wide projects (the environment, human rights, RBA) | |

| Risk Management Committee | Performs and shares information on company-wide risk management; establishes systems and mechanisms to investigate and counter risk scenarios for individual risk items in collaboration with risk owners | |

| Information Security Committee | Spreads awareness of information security strategies and policies; shares the current status of information security plans, etc. | |

| Export Trade Control Committee | Promotes export compliance activities | Annually |

Corporate Officers and Division Officers

We introduced our unique Corporate Officer system in June 2022 to further strengthen governance and implement quick decision-making and agile business execution. Corporate Officers are the highest-level officers on the executive side within the Group and are responsible for the management of the entire Group, taking the same perspective as the CEO. Corporate Officers also contribute to the promotion of proactive management by attending Board of Directors meetings and swiftly and appropriately implementing the content discussed at these meetings into business execution.

We have also established the Corporate Officers Meeting as the highest decision-making body on the executive side. Not only the Corporate Officers but aslo inside directors and inside Audit & Supervisory Board members also participate in such meetings. The meetings contribute to the realization of more agile business execution by quickly deliberating and making decisions on key matters on the executive side. (Fiscal year 2025: Held 21 times)

Furthermore, effective July 2024, we have renamed the position of division general manager (the head of each division) to Division Officer. Division Officers are responsible for the global operations of their respective divisions and are in charge of developing and executing effective strategies and promoting “offense × offense governance,” including risk management. At Division Officers Meetings, discussions are held on important themes in each division, as well as transformation and future evolution. The CEO also participates in these meetings. (Fiscal year 2025: Held 7 times)

Corporate Officer’s Message

Seisu Ikeda

Corporate Officer

Executive Vice President & General Manager

As the highest decision-making body on the executive side, the Corporate Officers Meeting (COM) has been able to make effective executive decisions with swift deliberation, even as the umber of responsibilities delegated by the Board of Directors increases. In fiscal year 2025, to further enhance the agility of the COM, we introduced the Division Officer system, thereby creating an environment in which the Corporate Officers (COs) can engage in discussions even more from the same perspective as the CEO. Of course, since the contents discussed within the COM are also shared with the Board of Directors meetings, we believe that the Board of Directors’ supervisory function over business execution is also being fulfilled.

Looking ahead, to enhance our corporate value over the medium to long term, the COM will engage in high-level discussions on numerous themes from the same perspective as the CEO, and work to communicate growth strategies—aligned with market expectations—in a timely manner.

Division Officer’s Message

Tatsuya Aso

Division Officer

Executive Officer

Whereas the COs make decisions on management execution from a company-wide perspective, we DOs are responsible for executing the day-to-day operations of each division and function. In doing so, we embody and promote Tokyo Electron’s basic stance of “offense × offense governance.” Our monthly Division Officers Meeting (DOM) is establishing itself as a forum for free and broad-minded discussion. Not only do we discuss initiatives towards achieving the Medium-term Management Plan, but each DO also brings forward themes related to Tokyo Electron’s medium- to long-term transformation and evolution for becoming number one in the world. Moreover, as members of Corporate Senior Staff (CSS), each DO collaborates with the top management of local subsidiaries in addressing the Group’s management challenges.

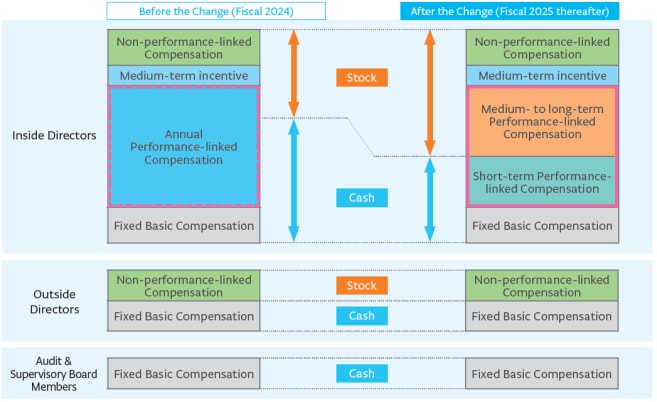

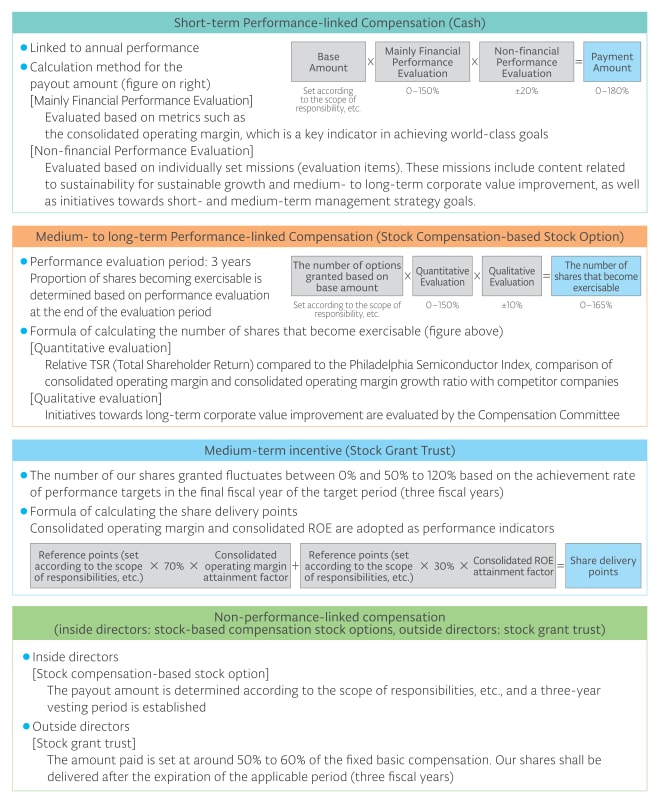

Director Compensation

From fiscal year 2025, to further strengthen the link with improving corporate value and performance over the medium to long term, the previous annual performance-linked compensation for inside directors was replaced with short-term performance-linked compensation (cash compensation) and medium- to long-term performance-linked compensation (stock-based compensation).

The proportion of stock-based compensation has consequently increased, resulting in a compensation system that is more focused on medium- to long-term growth.

Overview of the Director Compensation System

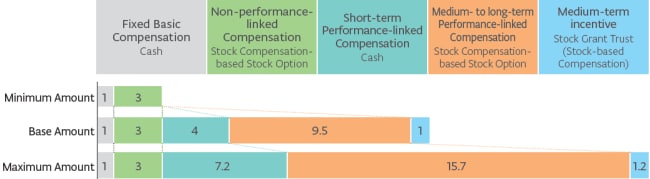

(Reference) Composition of compensation (compensation structure for the CEO in fiscal year 2025)

*Compensation ratios when fixed basic compensation is set as 1

Succession Plan

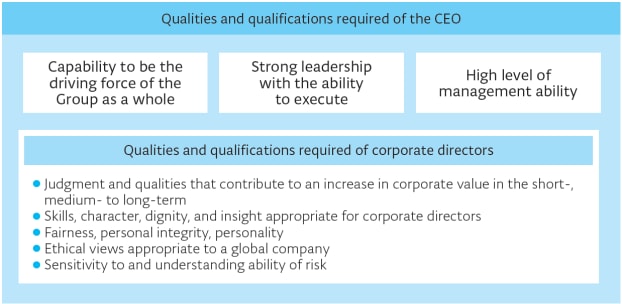

Our Nomination Committee Activity Guidelines define the required qualities and qualifications of the CEO and corporate directors (figure below), and the criteria that serve as starting points for considering the appointment/dismissal of the CEO.

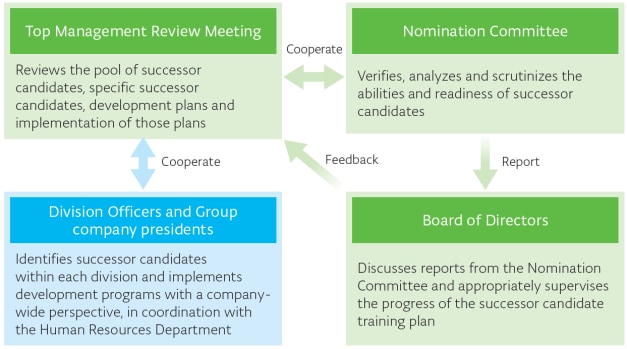

Regarding the development of CEO successors, we have formed a pool of candidates for the next generation of management personnel in accordance with the TEL Succession Plan, and we are working on the development of successor candidates under the supervision of the CEO, and in accordance with the Group’s management mission. Attended by the representative director, members of the Nomination Committee and the executive officer in charge of human resources, the Top Management Review Meeting works in coordination with the Nomination Committee and Board of Directors to promote specific successor candidates, development plans and implementation of those plans. It is our policy that, while the CEO is involved in promoting human resources development at the levels that could yield successor candidates, the CEO is not involved in the actual process of nominating specific candidates from the pool of successor candidates.

Message from the Nomination Committee Chairperson

Michio Sasaki

Outside Director

Nomination Committee Chairperson

Compensation Committee Chairperson

Under our Corporate Philosophy: “We strive to contribute to the development of a dream-inspiring society through our leading-edge technologies and reliable service and support,” we are striving to become a world-class, highly profitable company. In this context, formulating a CEO succession plan is a crucial challenge, and as Chairperson of the Nomination Committee, I feel a heavy responsibility in addressing this challenge. Successor candidates are selected in close collaboration with the CEO, corporate directors, Corporate Officers, members of the Nomination Committee, the executive officer in charge of human resources and other relevant people, and the Nomination Committee engages in discussion with the goal of ensuring that succession to CEO occurs with the most suitable person at the most appropriate time, taking into account the roles and periods of experience they should gain for their development. Recognizing the importance of continuously developing the next generation of management personnel, we are further strengthening our initiatives. This includes formulating development plans at the Top Management Review Meeting, implementing executive training programs at TEL UNIVERSITY and the recent introduction of external assessments.

Succession Plan Framework

Evaluation of the Effectiveness of the Board of Directors

To further enhance our governance and the effectiveness of the Board of Directors, we have conducted annual evaluations of the effectiveness of the Board since fiscal 2016 and have disclosed summaries of the results. In light of the analysis by external experts based on questionnaires and individual interviews reflecting on the activities during fiscal year 2025, we conducted a self-evaluation following extensive discussion at meetings of the Board of Directors and at meetings for the exchange of opinions between outside directors and outside Audit & Supervisory Board members.

| Issues and Responses in Fiscal year 2024 | |

|---|---|

| Issues | State of Responses |

Role and function of the Board of Directors

|

|

| Further strengthening of executive structure and acceleration of succession planning

|

|

| Overview of Fiscal year 2025 Evaluation Results and Future Initiatives | |

|---|---|

| Overview of Evaluation Results | Future Initiatives |

|

(Role and function of the Board of Directors)

|

Fiscal year 2025 Main Topics for the Board of Directors and Off-site Meetings

| CEO |

|

|---|---|

| Medium- to Long-term Growth Strategies |

|

| Sustainability |

|

| Risk/ Compliance |

|

| Corporate Governance |

|

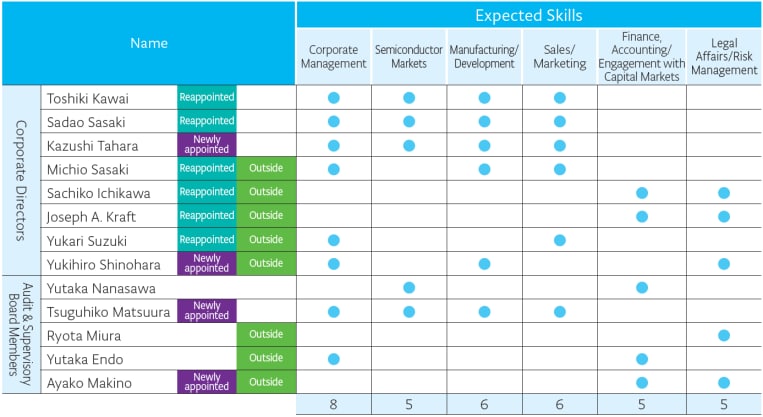

Skills Matrix

We will realize medium- to long-term profit expansion and continuous corporate value enhancement through each corporate director and Audit & Supervisory Board member, who have demonstrated their skills in Global Business, Governance, Sustainability, and others listed below as determined by the Nomination Committee and the Board of Directors.

Definition of Expected Skills and Reasons for Nomination

| Corporate Management | Experience of corporate management (experience serving as a representative director or chairman/president) is necessary to fulfill the supervisory function of the Board of Directors and achieve “offense × offense” governance. |

|---|---|

| Semiconductor Markets | Knowledge of the semiconductor markets is necessary to further promote aggressive management in the semiconductor production equipment industry which is characterized by rapid technological innovation and dynamically changing market. |

| Manufacturing/ Development | Knowledge/experience in manufacturing and development at TEL and other manufacturers are necessary to strengthen research and development capabilities based on technological trends and customer needs, and to establish environmentally considerate and efficient manufacturing operations. |

| Sales/Marketing | Knowledge/experience in sales and marketing at TEL and other manufacturers are necessary to be the sole strategic partner for our customers and contribute to further value creation through proposing optimal solutions. |

| Finance, Accounting/ Engagement with Capital Markets | Knowledge in financial accounting and M&A, or knowledge/experience in engagement with capital markets are necessary to formulate and execute growth and financial strategies, improve capital efficiency, and further enhance shareholder value through shareholder returns. |

| Legal Affairs/Risk Management | Knowledge of legal affairs, compliance, and risk management is necessary to appropriately respond to increasingly complex and diverse risks throughout the Group as opportunities for business growth. |

Message from the Chairman of the Board of Directors

Kazushi Tahara

Newly appointed Corporate Director

(Chairman of the Board of Directors)

Tokyo Electron’s vision is to be “a company filled with dreams and vitality that contributes to technological innovation in semiconductors.” We aim for medium- to long-term profit expansion and continuous corporate value enhancement by pursuing technological innovation in semiconductors and utilizing our expertise to continuously create high value-added, leading-edge equipment and technical services. To realize this vision, the Board of Directors has continuously worked to establish and strengthen our corporate governance structure. This has been done to ensure fair and transparent management and to anticipate and respond to various evolving global risks from a medium- to long-term perspective.

In fiscal year 2023, we introduced the Corporate Officer system to further promote offensive management on a global basis and to achieve short-, medium- and long-term profit expansion and continuous enhancement of corporate value. The Board of Directors has appropriately proceeded to delegate authority to the Corporate Officers Meeting (the highest decision-making body on the executive side), thereby enabling the Board to focus more on its supervisory function. Then in fiscal year 2025, we introduced the Division Officer system. Under this new framework, corporate officers are able to focus more on higher-level management issues, while Division Officers—composed mainly of the next generation of management personnel—are tasked with supervising business execution. Additionally, to further enhance our governance and the effectiveness of the Board of Directors, we have conducted annual evaluations of the effectiveness of the Board since fiscal 2016, deepened discussions on the desired vision of our Board and operational systems, and implemented initiatives for improvement as appropriate.

In fiscal year 2025, we achieved our highest-ever net sales and operating income since Tokyo Electron was founded. In our Medium-term Management Plan, we have set targets of net sales of 3 trillion yen or more, an operating margin of 35% or more, and an ROE of 30% or more by fiscal 2027. One of our strengths is our open and flat corporate culture. Even within the Board of Directors, we place great value on preserving this positive culture. As we work toward achieving the Medium-term Management Plan, we will continue to engage in dynamic discussions, make the best possible decisions in a timely manner, and operate an effective Board of Directors that meets the expectations of the capital market, drives sustainable growth and enhances medium- to long-term corporate value.

Messages from Newly Appointed Executives

Yukihiro Shinohara

Newly appointed Outside Director

Tokyo Electron is a global company leading the semiconductor industry, and I am honored to be a member of its Board of Directors. I identify with the Company’s Corporate Principles and have always had a high regard for its technological excellence and spirit of innovation. Throughout my career, I have been committed to valuing customers and building businesses through technology. In conducting B2B business, I believe that sound growth hinges on how quickly we can make and execute proposals that shape society and contribute to our customers. These are uncertain times, but at the same time, they are an opportunity for transformation and growth. As a corporate director, I hope to support each and every one of our global team so they can take on challenges confidently and through open communication.

In line with our Corporate Philosophy—to “strive to contribute to the development of a dream-inspiring society”—I will fulfill my responsibilities to enhance corporate value and contribute to all our stakeholders.

Messages from Newly Appointed Executives

Tsuguhiko Matsuura

Newly appointed Audit & Supervisory Board Member

In my view, one of Tokyo Electron’s sources of growth is its pursuit of challenges and its ability to transform itself. When I joined the Company approximately 40 years ago, it still retained the unmistakable atmosphere of a technology-focused trading company from its founding days. From a trading company to a manufacturer, and through global expansion, Tokyo Electron continues to grow through innovation to this day. The social environment surrounding us and the norms expected of us are also changing significantly, so our approach to governance and compliance must also constantly transform. As a member of the Audit & Supervisory Board, I fully recognize the weight of this responsibility. Drawing on my experience in managing business departments within the Company and local subsidiaries overseas, I will strive to live up to the trust of our shareholders and all other stakeholders.

Messages from Newly Appointed Executives

Ayako Makino

Newly appointed Outside Audit & Supervisory Board Member

I am honored to be appointed as an outside Audit & Supervisory Board member of Tokyo Electron, a global leader in the field of semiconductor production equipment, pursuing technological innovation in semiconductor technology that supports the sustainable development of society. While demand for semiconductors is rapidly increasing with the spread of AI and IoT, U.S. tariff policy may affect Japanese semiconductor production equipment manufacturers, and I believe management decisions will require even greater caution going forward.

As a certified public accountant, I have spent approximately 30 years at a major auditing firm supporting the sound growth and sustainable management of companies. I have also served as Audit Committee Chair within the firm and its group, where I dedicated myself to strengthening corporate governance and enforcing thorough risk management. Drawing on my past experience, I will contribute to enhancing corporate value and building trust with all stakeholders in my role as an Audit & Supervisory Board member. While ensuring fairness and transparency, I will fulfill my role in further enhancing corporate governance and supporting sustainable growth.

Engagement with Capital Markets

Our management actively engages in IR (Investor Relations) and SR (Shareholder Relations) activities to contribute to our sustainable growth and increase corporate value over the medium to long term.

In terms of IR activities, the CEO and executives in charge present at quarterly earnings release conferences, the Medium-term Management Plan briefings and IR Day to share our business strategies and growth story with stakeholders and institutional investors. We have also established the IR Department to deepen discussions with our investors. In fiscal year 2024, we established the IR branch in New York, which increased opportunities for face-to-face dialogue with investors in North America, and we are working to increase awareness of our company and Japan’s semiconductor production equipment industry.

Furthermore, the interests of our investors in fiscal year 2025 were, in addition to market trends and business performance overviews, leading-edge technology, competitiveness and geopolitical impact.

As a part of our SR activities, company executives play a central role in constructive dialogue with our major investors and proxy advisory firms. In addition to explaining the Shareholders’ Meeting agenda in advance, we engage in repeated dialogue throughout the year on a wide range of topics, such as initiatives for sustainability, which include corporate governance, the environment, human rights and DE&I, and we work to deepen mutual understanding while making our efforts lead to greater disclosure. Opinions gathered from this dialogue are regularly reported to management and the Board of Directors.

Main Activities

| Engagement with Capital Markets*¹ |

IR Activities |

|

|---|---|---|

| SR Activities |

|

|

| Provision of Information | Financial Announcement Medium-term Management Plan Announcements IR Day |

|

| Shareholder’s meeting |

|

|

|

Disclosure of Materials

|

IR-related |

|

Fiscal year 2025

Including tours of plants and overseas IR road shows

Overseas IR road shows: IR activities presented directly to shareholders and investors