Notice Regarding Continuation of Stock Delivering Scheme for the TEL Group Officers in Japan and Abroad

The Board of Directors of Tokyo Electron (“Company”) have resolved in a meeting held on July 26, 2019, to continue the stock delivering scheme ("the Scheme") in FY2019, which has been introduced in FY2018, as a common global incentive plan linked to the medium-term performance for directors (excluding outside directors, "Eligible Directors"), the senior employees and mid-class employees including executive officers ("Eligible Employees", and collectively with Eligible Directors, “Eligible Persons”) of the Company and group companies in Japan and abroad (“Relevant Companies”).

Description

1. Purpose of introduction of the Scheme, etc.

(1) We have introduced the Scheme from FY2018 as an incentive plan that is closely linked to the Company performance in order to underline for Eligible Persons the importance of contributing to the Group’s medium-term performance and increasing the enterprise value in under the global framework. At our Company, dynamism and vitality is created by the entrepreneurial spirit of staff members, especially the senior-employees and mid-class employees, holding in mind a shared purpose with the top management team to realize the Company’s business targets in line with the top management team. To this end, we have introduced the Scheme to align the work of executive officers, senior employees and mid-class employees in order to achieve specific, high-level targets in the capital markets as well as our business and financial targets in the markets in which the Company operate.

(2) The Scheme for Eligible Directors has a mechanism called the Officers' compensations Board Incentive Plan (“BIP”) Trust ("BIP Trust"). The BIP Trust is a similar scheme to performance-linked, stock-based remunerations (Performance Share) and stock-based compensations with transfer restrictions (Restricted Stock) in the US and Europe, and shares of the Company and the monies corresponding to cash conversion value of the Company Shares etc. ("Company Shares etc.") are delivered or provided ("delivered") to directors. Two BIP Trusts will be set up according to the following Eligible Persons categories.

BIP Trust I: Directors of the Company

BIP Trust II: Directors of the Group companies

The Scheme for Eligible Employees has a mechanism called the stock-delivering ESOP (Employee Stock Ownership Plan) Trust ("ESOP Trust"). The ESOP Trust is an employee incentive plan based on ESOP schemes in the US whereby the Company Shares etc. are delivered to Eligible Employees according to their position and attainment of performance targets etc.

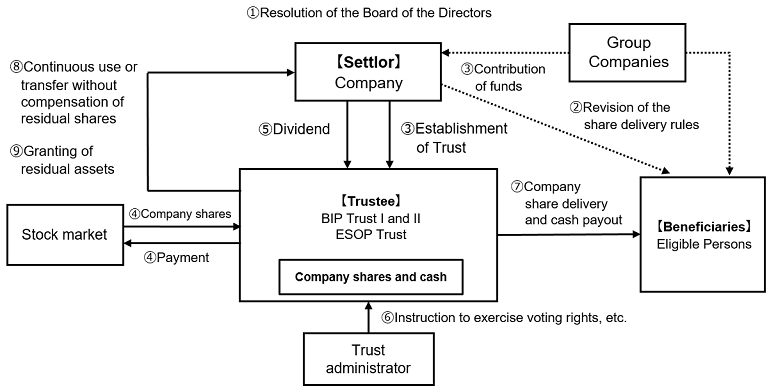

2. Structure of the Scheme

| BIP Trust I and II | ESOP Trust | |

|---|---|---|

| ① | Each Relevant Company shall obtain a resolution from the Board of Directors Meeting for continuation of the Scheme. | |

| ② | Each Relevant Company will partially revise share delivery rules concerning the Scheme at the Board of Directors meeting. | |

| ③ | The Company shall set up a BIP Trust I for the benefit of the Company directors who meet the beneficiary requirements, a BIP Trust II for the benefit of the Group company directors who meet the beneficiary requirements, and an ESOP Trust for the benefit of Eligible Employees who meet the beneficiary requirements ("the Trust"). Each Relevant Company contributes to the trust fund within the scope resolved in ①. | |

| ④ | The Trust will, in accordance with instructions from the trust administrator, use the trust money to acquire the Company shares from the stock market. | |

| ⑤ | Dividends on the Company shares in the Trust will be distributed with other shares of the Company. | |

| ⑥ | The voting rights of the Company shares within the Trust shall not be exercised. | The voting rights of the Company shares in the Trust will be exercised in accordance with instructions from the trust administrator. |

| ⑦ | Eligible Persons shall be delivered points based on their position and attainment of performance targets according to the share delivery rules. The Eligible Persons meeting the beneficiary requirements shall have the Company Shares etc. and the cash conversion value delivered from the Trust according to the relevant number of points. | |

| ⑧ | In the cases where there are residual shares at the expiration of the trust period, the Trust will continue to be used for the Scheme or same kind of stock delivering scheme, or a transfer without compensations of these residual shares will be made to the Company. | |

| ⑨ | Any residual assets at the termination of the Trust will be vested in the Company within the limit, which is calculated by deducting from the trust money the cost for acquiring the shares. | |

3. Scheme Details

(1) Scheme overview

The Scheme continuing in the current fiscal year deliveries Company Shares etc., based on the position and attainment level of performance targets etc. to Eligible Persons for the three fiscal years ("Term") starting in the fiscal year ending 31 March 2020 and ending in the fiscal year ending 31 March 2022.

The Company establishes a Trust for continuing the Scheme in the current fiscal year, and plans to continue running similar incentive plans by setting up a new Trust each year from the next fiscal year onwards or continuing the Trust according to (3) ② below. The relevant Term of each Incentive Plan that will run in the next fiscal year onwards shall be for three fiscal years from the fiscal year during which the Trust for the Incentive Plan is set up or continued.

(2) Eligible Persons under the Scheme (Beneficiary Requirements)

As a general rule, Eligible Persons may be delivered Company Shares corresponding to the number of stock delivering points (see (4) below) by the Trust after undergoing set procedures for confirming beneficiary rights outlined below has been met at the end of the relevant term.

① He/she was in position and working as an Eligible Person during the first fiscal year in the relevant Term.

② The number of stock delivering points set out in (4) below has been determined.

③ The person has not committed certain illegal acts while in office or left the position due to a result of his or her own circumstances or termination etc.

④ Other requirements that are deemed necessary to achieve the purpose of the Stock Delivering Scheme

(3) Trust term

① The trust term (the Trust establishing in the current fiscal year)

Approximately 3 years from August 1, 2019 (planned) until the end of August 2022 (planned). The trust term for the Trusts that will be set up in the next fiscal year onwards is also scheduled to be approximately 3 years.

② Continuation of the Trust

The Trust may continue beyond the trust term shown in ① above through changes to the trust agreement or by arranging for an additional trust. In those cases, the trust term of the Trust will be extended by further 3 years, and the Company will make an additional contribution to the Trust for each extended trust term, and will continue to deliver points to Eligible Persons during the extended trust term. However, there will be additional contributions for BIP Trust I and II within the upper limit of trust funds as approved at the General Shareholders Meeting of Relevant Companies, and when making an additional contribution, if at the end of the trust term prior to extension there are remaining Company Shares (excluding Company Shares which have not been delivered but corresponds to the stock delivering points delivered to the Eligible Director) and monies ("Remaining Shares, etc."), the total amount of the Remaining Shares, etc. and the total amount of the additional contribution to the trust funds shall be limited to the upper limit of the trust funds that have been approved at the General Shareholders Meeting at the Relevant Company. Extension to the trust term is not limited to once only, and the trust term may be re-extended thereafter in a similar manner.

(4) The Company Shares etc. that will be delivered to Eligible Persons

The number of stock delivering points will be calculated by applying the following formula and the Company Shares etc. that will be delivered to Eligible Persons will be based on 1 Company Share per 1 point. If the Company Shares etc. are subject to a split or a merger during the trust term, the number of Company Shares per point and the upper limit of shares shown in (6) below shall be adjusted according to the Company stock split ratio or the merger ratio, etc.

(Formula for calculating stock delivering points)

Reference point (*1) x performance-linked factor (*2)

(*1) The reference point is determined by deducting the share price at the time the Trust acquired the Company stock from the reference amount determined according to the position in the first year of the relevant term (if the trust term of the Trust has been extended through changes in the trust agreement or putting it in an additional trust, then the average acquisition unit price for the Company stock that will be obtained by the Trust after the extension), and shall be delivered in thirds, one-third of the portion allotted per relevant term. If Eligible Persons are delivered the Company Shares etc. before the end of the relevant term (see (5) below), the number of total points delivered for shares at the time will be used as the basis for calculating stock delivering points.

(*2) The performance-linking factor fluctuates between 0% and 120% according to the attainment level of performance targets during the relevant term (e.g. target consolidated operating margin or consolidated ROE etc.). However, if Eligible Persons are delivered the Company Shares etc. before the end of the relevant term (see (5) below), the performance-linking factor shall be deemed to be 50% for calculating the number of points for the delivery of shares. The indicators for evaluating the attainment level of performance targets for the relevant term shall be the consolidated operating margin and the consolidated ROE in the fiscal year ending 31 March 2022, and the formula for stock delivering points is "reference points x 0.7 x consolidated operating margin attainment factor + reference points x 0.3 x level of factors in consolidated ROE attainment".

(5) Timing and method of issuing Company Shares etc. to Eligible Persons

The Eligible Person who have met the beneficiary requirements shall have the Company Shares etc. delivered after the end of the relevant term (if the Eligible Person dies or the Eligible Employee retires at mandatory retirement age before the end of the relevant term, then at the time of death or retirement), shall have Company Shares etc., delivered.

The applicable Eligible Person shall be delivered the number of shares corresponding to a certain percentage of stock delivering points, and the remainder shall be converted within the Trust, and shall be provided with monies equivalent to the cash conversion value.

However, if an Eligible Employee who retires involuntarily or at mandatory retirement age before the end of the relevant term or if an Eligible Person who is not a resident in Japan does not have a securities account etc. for dealing in Japanese stocks, all stock delivering points will be converted by the Trust for the amount corresponding to the cash conversion value. In addition, if the Eligible Person dies before the end of the relevant term, the Company stock corresponding to the number of points delivered for shares at the time will be converted within the Trust, and the successor of the relevant Eligible Person shall receive monetary benefits equivalent to the cash conversion value.

(6) The upper limit of trust fund contribution to the Trust and the upper limit of Company Shares etc., delivered by the Trust

For BIP Trust I and II, the upper limit of trust fund contribution for the Trust during the trust term and the upper limit of the Company Shares etc. to be delivered to Eligible Directors shall be subject to the following upper limit (with respect to BIP Trust II, on the condition that the upper limit is approved by the General Shareholders Meeting at Group companies).

① The upper limit of trust fund contribution to the Trust

BIP Trust I: 480 million yen

BIP Trust II: 300 million yen

(Calculated based on stock acquisition funds used by the Trust during the trust term, trust fees and trust expenses)

② Upper limit for Company Shares that will be delivered to Eligible Persons from the Trust

BIP Trust I: 23,800 shares

BIP Trust II: 16,000 shares

(They are set in reference to the current share price etc., taking into account the upper limit of the trust fund as shown above.)

(7) Method for acquiring the Company Share through the Trust

Acquiring the Company Shares etc. under the Trust set up during the current fiscal year are expected to take place on the stock market within availability of funds for stock acquisition shown in (6) above and the number of shares delivered.

(8) Exercise of voting rights accompanying the Company Shares etc. within Trust

For the Company Shares etc. within BIP Trust I and II, no voting rights shall be exercised during the trust term, in order to ensure neutrality towards management.

For shares within the ESOP Trust, the trust administrator will provide direction on exercising voting rights as a shareholder, and the ESOP Trust will exercise the voting rights accordingly.

(9) Handling of dividends for Company Shares in the Trust

The dividends paid on Company Shares held in the Trust shall be used for the trust fees and trust expenses after receipt by the Trust.

(10) Handling of remaining shares and dividends at the end of the trust term

The remaining shares arising from termination of the trust term due to non-attainment of performance targets during the relevant term, changes to the trust agreement or making additional trust requirements may be used by the Scheme or a similar stock delivering scheme.

Further, the remaining dividends on the Company Shares within the Trust at maturity of the stock term will be used as stock acquisition funds when using the Trust, however, if the Trust will be terminated at the end of the trust term, the amount exceeding the trust expense reserve is planned to be donated to an organization with no interest in the Company or any Eligible Persons.

(Reference)

【Trust agreement contents】

| BIP Trust I | BIP Trust II | ESOP Trust | |

|---|---|---|---|

| ① Eligible Persons: | Company Directors (8 members) |

Relevant Companies Directors (14members) | Participating Employees |

| ② Trust type: | An individually-operated designated trust of cash other than cash trust (third party benefit trust) | ||

| ③ Trust purpose: | To deliver incentive to the subject of plan | ||

| ④ Settlor: | The Company | ||

| ⑤ Trustee: | Mitsubishi UFJ Trust and Banking Corporation(Co-trustee: The Master Trust Bank of Japan, Ltd.) | ||

| ⑥ Beneficiaries: | The subject of plan satisfying the beneficiary requirements | ||

| ⑦ Trust Administrator: | A third-party who does not have any interest in the Company (certified public accountant) | ||

| ⑧ Trust agreement date: | August 1, 2019 (planned) | ||

| ⑨ Trust period: | August 1, 2019 (planned) to the last day of August, 2022 (planned) | ||

| ⑩ Start of scheme: | August 1, 2019 (planned) | ||

| ⑪ Exercise of voting rights: | Not exercised | Exercised | |

| ⑫ Type of acquired shares: | The Company’s ordinary shares | ||

| ⑬ Method of share acquisition | To be acquired from the stock market | ||

| ⑭ Period of share acquisition: | From August 2, 2019 (planned) to August 30, 2019 (planned) | ||

| ⑮ Amount of trust money | 312.6 millionyen | 174.08 million yen | 3,607.48 million yen |

| (includes trust fees and trust expenses) | |||

| ⑯ Holder of the vested right: | The Company | ||

| ⑰ Residual assets: | Residual assets that can be received by the Company, which is the holder of the vested right, shall be within the limit of the trust expense reserve, which is calculated by deducting from the trust money the expense for acquiring the shares. | ||

Note: The above schedule is subject to change at appropriate times in light of applicable laws and regulations.

【Trust/share related back office】

① Trust clerical work: Mitsubishi UFJ Trust and Banking Corporation will be the trustee of the Trust and engage in affairs related to The Trust.

② Share clerical work: Mitsubishi UFJ Morgan Stanley Securities Co., Ltd. will engage in affairs related to delivering the Company shares to beneficiaries based on the service agreement.