- Semiconductor Technology Now

Report Series

Issues to be addressed for smooth vehicular communications

There are a few issues to be resolved before current wireless communication technologies can be applied to automated driving.

For one thing, road-to-vehicle and inter-vehicular communications require a common "language"-called message set-to ensure the data can be exchanged without a hitch. The message set prescribes how specific types of information should be described, for instance the vehicle's ID data, location, running condition, and data on its surroundings. Although different countries and regions are using different message sets today, they ought to be standardized in the future.

Before self-driving cars can be released on the market, it is important to verify the interoperability of the onboard equipment and roadside equipment from different manufacturers. Just as wireless LAN equipment for PCs is not 100% compatible with each other even when the same technology standards are followed, vehicular communication devices may also have individual quirks that affect interoperability. To avoid any such inconvenience, an interoperability certification program and test facilities must be established so each product can be tested and approved before being released.

The threat of electronic car-jacking by hackers

The trouble with inter-vehicular communication systems is that their benefits are initially not very tangible. This could be problematic, because inter-vehicular communications do not work properly unless a large majority of cars are equipped with a data transceiver. As a solution to this problem, Honda has proposed using a smartphone as an inter-vehicular communications device. Although there are some issues regarding reliability and communication range, this idea could be an effective solution if properly implemented. Honda joined forces with Qualcomm, a mobile phone semiconductor chip manufacturer, and has successfully developed an IEEE 802.11p-compatible chip for smartphones. If both drivers and pedestrians carry mobile phones fitted with this chip, the cars would sense any unseen pedestrians around the corner to avert accidents.

Another issue of paramount importance is security. As more vehicles are connected wirelessly with roadside infrastructures and other vehicles, they face the risk of being hacked and manipulated, just as PCs and smartphones do.

In 2013, a group of well-known hackers found ways to break into the onboard systems of Toyota Prius and Ford Escape, and urged caution by disclosing how to hack those systems. Automakers were understandably dumbstruck. The hackers allegedly caused the Prius to brake suddenly while moving at 130 km/h, and operated the steering wheel against the driver's will. Semiconductor manufacturers and software vendors have been hard at work to propose various security measures that could prevent such an occurrence.

Auto manufacturers' fray for maps

Automated driving requires not only accurate perception of the surroundings using onboard sensors, but also highly detailed maps that provide schematic information about the road ahead, including its inclination and the number of lanes. For an onboard computer to calculate the best way to control a vehicle, the map information has to be three-dimensional.

There are a number of reputable map providers for car navigation systems, including Zenrin and Increment P in Japan, and HERE and TomTom based in Europe. The current maps for car navigation systems do not have adequate data needed for automated driving, however, and so map providers are scrambling to draw more detailed 3D maps.

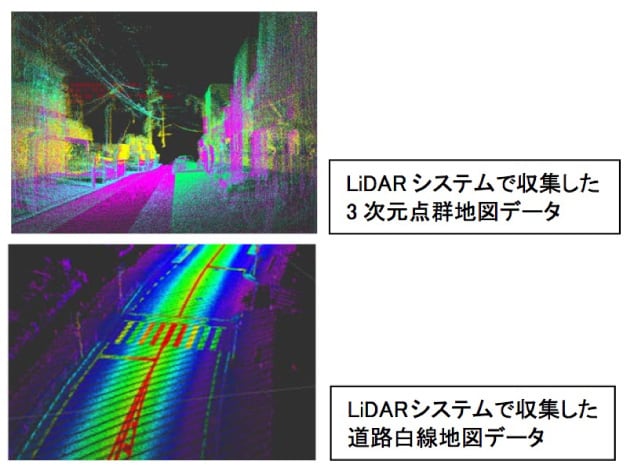

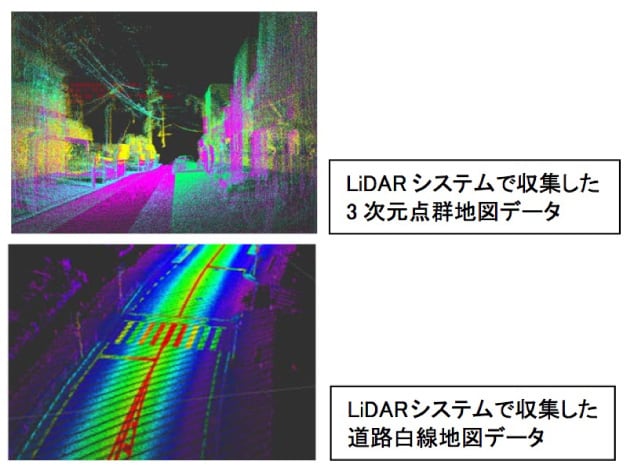

Mapmakers based in Europe and the U.S. are adopting maps of terrains and structures rendered in 3D point clouds as the standard for automated driving. For example, HERE acquired earthmine inc. together with its highly detailed 3D mapmaking technology. HERE now operates 200-250 data collection vans to draw proprietary 3D maps called HD maps. Each van is equipped with a radar similar to the lidar of the Google Car, and collects data while driving around. HERE is also partnering with Pioneer to use the latter's 3D-LiDAR driving space sensor to draw more accurate maps (Figure 5). Pioneer is providing the same mapmaking technology to its subsidiary Increment P.

|

3D point cloud map data collected by the LiDAR system |

|

White lane markings data collected by the LiDAR system |

In the future, HERE may use sensors installed on users' cars to upload captured data on a cloud and improve the HD maps. This could identify slippery roads and tricky crossings where many drivers hit the brakes suddenly, and the information can be shared by other cars to improve safety.

Because high quality electronic maps are the key content for enabling automated driving, auto manufacturers and Tier 1 companies (those that directly supply components to automakers, as opposed to Tier 2 companies that supply parts to Tier 1 companies) are fiercely competing with each other so as to form exclusive partnerships with map providers. HERE, for instance, used to be a business partner of Continental (a Tier 1 company), but was later acquired by a consortium of automakers including BMW, Daimler, and Audi. TomTom has a partnership with Bosch, another Tier 1 company.